Source: amazon.com/gap

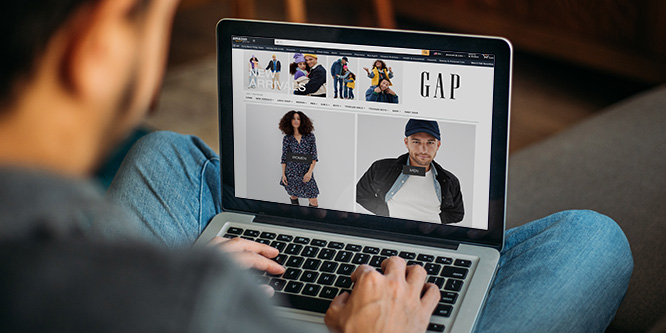

Gap is for sale on Amazon.com.

Gap made “thousands” of its items available last week at Amazon.com/Gap with the promise of “fast, free Prime delivery.”

“Collaborating with Amazon Fashion provides us a new channel to deliver Gap’s modern American essentials to even more customers in the U.S. and Canada,” said Mark Breitbard, president and CEO, Gap brand, in a statement.

Gaining access to customers across the world’s largest online selling platform could provide a much needed boost for the struggling Gap brand that has closed a third of its stores over the last decade. Gap merchandise has been available through third-party sellers on the platform.

Amazon gains another key fashion resource. Birkenstock in 2016 and Nike in 2019 stopped selling direct through Amazon but the retail giant now has dedicated storefronts for most brands that sell in traditional department stores, including Polo Ralph Lauren, Calvin Klein, Michael Kors, Kate Spade, Levi’s, Adidas and The North Face.

A number of luxury labels, such as Gucci, Burberry and Coach, do not sell directly on Amazon, nor do most vertically-integrated chains – e.g., Lululemon, H&M, American Eagle Outfitters and L.L. Bean. Gap’s sister chains, Old Navy, Banana Republic and Athleta, do not yet list product on Amazon.

In a partnership announced in April, Victoria’s Secret became the first major vertically-operating chain to open an Amazon storefront, although it is restricted to beauty products and Pink casual apparel.

Gap’s shares rose nearly nine percent on news of the partnership, given the potential to tap Amazon’s customer reach.

Jinjoo Lee, The Wall Street Journal’s “Heard on the Street” columnist, sees potential negatives for Gap, such as giving up a portion of sales proceeds and customer data as well as the overlap with Amazon’s private label offerings.

She added, “Coming to Amazon can also harm brand perception because Amazon is a marketplace for everything — not exactly a curated platform and one associated with value rather than exclusivity. In short, it is not a decision that a clothing brand, especially such a household name, would make unless its business outlook is looking very bleak.”

- Gap Launches Collection Of Family Essentials With Amazon Fashion In U.S. And Canada – Gap

- Gap Amazon – Amazon.com

- Gap’s Amazon Partnership Is a Desperate Look – The Wall Street Journal

- Gap launches its store on Amazon – CNN

- Gap Partners With Amazon on Distribution Deal – WWD

- Victoria’s Secret & PINK Beauty Launches in Amazon’s Store – Victoria’s Secret & Co.

- What happens now that Nike has called off its deal with Amazon? – RetailWire

- What will a Nike/Amazon deal mean for the brand and other retailers? – RetailWire

- Will other brands follow Birkenstock in cutting off Amazon? – RetailWire

Leave a Reply

You must be logged in to post a comment.