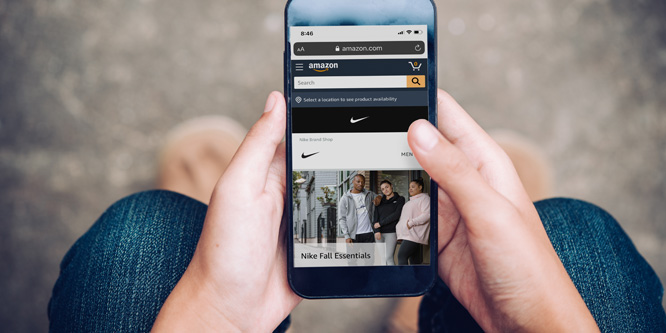

Source: Amazon.com/Nike

In 2017, Nike was hoping to reduce the sale of counterfeits and increase those of its own products when it signed a pilot deal to sell directly to Amazon.com. Whatever benefits Nike derived from its direct business relationship with Amazon evidently weren’t enough. The brand is ending its test with the e-tail giant.

A statement issued by Nike says the company intends to focus more on its own consumer direct efforts along with “distinctive partnerships … with other retailers and platforms to seamlessly serve our consumers.”

The development comes on the heels of last month’s announcement that former eBay CEO John Donahoe will take over as Nike’s chief executive in January.

Many see Mr. Donahoe’s hiring as a sign that Nike intends to ramp up its consumer direct digital transformation strategy. Nike, which generated about 15 percent of its sales from its own website and retailer partner sites last year, has previously said it sees that percentage rising to 30 percent by 2023. The company expects that online sales of its products will eventually surpass those sold in stores.

Nike reported that sales for its first-quarter ending on Aug. 31 were up seven percent overall, driven by a 42 percent increase in digital sales. Earnings for the quarter were up 28 percent.

In August, the brand launched Nike Adventure Club, a digital subscription service providing sneakers to kids between the ages of two and 10. Members can choose from three different options, which range from receiving four pairs of sneakers per year up to 12 and costing $20, $30 or $50 a month. Nike rolled out the program after a pilot that involved 10,000 members.

The decision by Nike to end its deal with Amazon may raise questions about an agreement it signed with Walmart’s Jet.com in 2018. At the time, J. David Echegoyen, Jet.com’s former chief customer officer, told Business Insider that its deal with Nike differed from others the brand had signed that featured “a mere assortment of basics” sold online.

- Nike Will End Pilot Project Selling Products on Amazon Site – Bloomberg

- Nike to Stop Selling Directly to Amazon – The Wall Street Journal

- Will Nike’s new CEO accelerate its consumer-direct digital transformation? – RetailWire

- What will a Nike/Amazon deal mean for the brand and other retailers? – RetailWire

- Is Nike’s new subscription program for kids a parent’s best friend? – RetailWire

- Nike sees online eclipsing offline sales – RetailWire

- Nike expects sales to take off with launch on Jet.com – RetailWire

Leave a Reply

You must be logged in to post a comment.