Source: Amazon

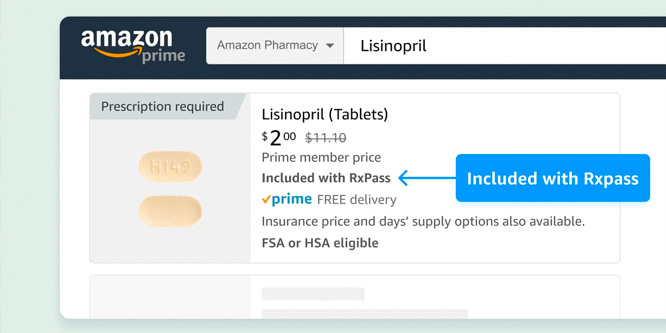

Amazon.com today introduced RXPass, a new subscription plan that enables Prime members to buy prescription medicines for more than 80 common health conditions delivered to their homes for $5 a month in total.

The program uses generic versions of brand name drugs to keep prices in check. Prime members can enroll by going online or using the Amazon app to update their pharmacy profile. Amazon will verify their eligibility and prescription information once Prime members are signed up for RxPass. Customers with questions can reach out to Amazon pharmacists 24/7.

“Prime members already get fast, free delivery on prescription medications, and RxPass is one more way to save with Amazon Pharmacy,” said John Love, vice president of Amazon Pharmacy, in a statement. “Any customer who pays more than $10 a month for their eligible medications will see their prescription costs drop by 50 percent or more, plus they save time by skipping a trip to the pharmacy. We are excited to offer our customers surprisingly simple, low pricing on the eligible medications they need each month.”

Amazon again appears to be relying on its low price image, plus free shipping, to drive its success in pharmacy. A 2022 Profitero study, which analyzed online prices for nearly 15,000 products across 15 non-Rx categories at 13 retailers, found that Amazon had the lowest price in 14 of them. It tied Chewy in the pet products category.

Competition within the pharmacy space continues to heat up as Amazon, CVS, Walgreens, Walmart and others make aggressive moves within primary healthcare services.

Amazon is looking to close on its $3.9 billion all-cash acquisition of One Medical, a “technology-powered national primary care organization” that combines in-person, digital and telehealth services to care for patients. The proposed deal, which was announced last July, still has to clear regulatory hurdles before it can close.

Walgreens under Roz Brewer has been particularly aggressive, focusing its efforts on becoming a leading healthcare provider. The drugstore giant has been rapidly scaling its VillageMD clinics offering primary care services under the care of doctors in its stores. Walgreens expects to have 1,000 clinics in operation across the country by 2027. It has also gained a controlling interest in CareCentrix, which coordinates visits by medical professionals to patients’ homes after they have been discharged from hospitals.

- Amazon Pharmacy Introduces RxPass: Unlimited Prescription Medications for Only $5 a Month, Delivered Free to your Door — Available Exclusively for Prime Members – Amazon.com

- Is being the low price leader critical to Amazon’s ongoing success? – RetailWire

- Is Amazon on the verge of reinventing American healthcare? – RetailWire

- Will making house calls redefine CVS and Walgreens’ relationships with their customers? – RetailWire

Leave a Reply

You must be logged in to post a comment.